- Special Expertise in Renewable Energy and Public Private Partnerships

- Solid Track Record in Driving the Closing Process

- Proprietary Screening Process to Identify Issues Early

- Focus on Risk Mitigation, Especially Construction Risk

- Project Development Services

Our Services

Project Finance Advisory

Project Financial Modeling

Project Finance Training

Project Finance Advisory Services

A Leading-edge Provider of Project Finance Advisory, Modeling, and Training Services Worldwide

Overall, GPFAC’s Project Finance Advisory Services include supporting negotiation of bankable commercial contracts; developing a bankable security package and financial structure; managing the processes of obtaining banking commitments and underwriting on behalf of sponsors; plus driving the closing process.

GPFAC can conduct a comprehensive review of a project finance transaction and produce a due diligence report that outlines the critical risks with possible solutions to mitigate these risks.

This can help drive the closing process by focusing resources on the major deal-breakers from a financing standpoint.

Special Expertise in Renewable Energy and Public Private Partnerships

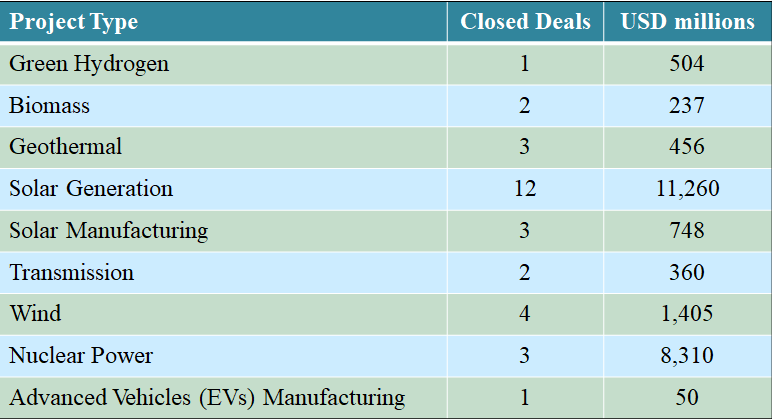

GPFAC has extensive experience in infrastructure projects, with special emphasis on renewable energy. We have closed ~50 projects in the renewable energy space totaling $48.4 billion worldwide.

Our experience is across spectrum of renewable energy technologies, including: Green Hydrogen, Biomass, Geothermal, Solar (Generation and Manufacturing), Wind, and Advanced Automotive (Electric Vehicles).

U.S. Department of Energy Experience

GPFAC is on the U.S. Department of Energy’s shortlist of approved financial advisors. We have closed $23.3 billion in DOE loan guarantees, in 31 projects, across sectors.

DOE Loan Guarantee Program – GPFAC closed projects experience:

Public Private Partnerships Experience

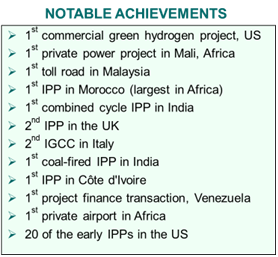

We have pioneered a number of Public Private Partnerships (P3) and have been the Advisor for several first-of-a-kind transactions. Several have been unique situations where GPFAC team members have successfully found solutions and successfully closed the transaction.

Here our experience in multiple roles such as sponsor, debt underwriter, and financial advisor.

Some of our notable achievements include:

- We managed the first phase of the world’s largest renewable energy storage hub for green hydrogen in Utah.

- We have supported several of the first IPPs around the world, covering North America, Europe, Asia, and Africa.

- We led the building of the First private airport in Africa.

In India, we closed two of the first of a kind IPPs. Further, our experience in India includes chairing an industry subcommittee that advised the Indian Government on the necessary legal and financial policy reforms needed its drive for privatization.

Driving the Closing Process

GPFAC focuses on what is essential to drive the closing process. We have the skill-set and the experience to deliver. We understand the local markets and where to find the right solutions. We have driven commercial negotiations and resolved conflicts of interest as a neutral third party. We are laser focused on tasks that are on the critical path, with realistic deadlines and responsibilities. Our attention to detail ensures that the extensive loan documentation required is completed efficiently and accurately.

GPFAC understands the sponsor’s needs because it has lived that role. Amongst other experiences, we have closed $12.1 billion in transactions in the role of project sponsor. These have included several pioneering projects such as finding innovative financial structures that meet local market needs.

GPFAC has developed a proprietary framework for commercial negotiations since sound commercial arrangements are a key to success in project finance.

- Parties need to be flexible to arrive at a win-win scenario.

- They must recognize that participants are driven by both business goals and personal aspirations. This results in complications that need to be managed.

- This framework helps save time by reducing significantly the need for renegotiating contracts.

- GPFAC has developed a workshop and training program that includes simulated role-play in a real-life EPC contract negotiation.

Proprietary Screening Process

GPFAC uses a proprietary screening process that identifies critical project issues quickly to resolve critical issues early, or even discontinue projects that are deem “not viable’. This saves scarce resources since the biggest cost in project development is pursuing projects that fail to close.

More projects fail than succeed, so a solid, comprehensive screening process is critical and cost saving!

At GPFAC, the same screening process applies, regardless of size, technology, structure, or geography.

Risk Mitigation

Construction Risk. GPFAC has a strong focus on risk mitigation as early as possible. A significant risk for most projects we work on is construction risk. GPFAC’s approach includes:

- Credit analysis of contractor and Parent Company

- Analyzing financial impact of operations at Minimum Performance levels

- Determining adequacy of LDs for failure to achieve Performance Guarantees, both for construction delay and the actual level of each performance guarantee measure.

- Developing individual caps as well as a total cap on LDs

Market Risk. Another notable commercial risk is market risk. To mitigate this risk, GPFAC will examine feedstock and off-take contracts, in conjunction with the Project’s legal and technical consultants. Further, we have our Teaming Organization, Frost & Sullivan, a world leader for market assessment.

Our primary objective is to allocate commercial volume and price risks to counterparties for feedstock supply and product off-take. Further, we establish scenarios for assessment which include a:

- Base Case (the most likely scenario);

- Conservative Case (based on typical lender assumptions); and

- Stress Case (a worst-case scenario).

The Conservative Case is used to structure the debt (financial structuring techniques). The Stress Case determines the Project’s ability to survive under adverse conditions. This also determines any additional sponsor support that may be required. The Base Case is typically used as the Owners’ model.

Financial Structuring to Mitigate Risk. The third area for mitigating risk is to use a variety of financial structuring techniques that Balance lender requirements with Sponsor’s objectives. This is a highly nuanced skill.

GPFAC approach to financial structuring is based on mitigating commercial risks through strong contracts, using financial structuring techniques to create a bankable project, and addressing other risks through a comprehensive insurance program.

Project Development

GPFAC has teamed up with EIC Partners AG (“EIC”) to strengthen our project development capability. EIC professionals have successfully developed some of the most complex energy infrastructure transactions around the globe. The combined development experience of GPFAC and EIC professionals is strong and broad. For example, some successful projects include: the largest power plant in Morocco, one of the leading CCGT fleets in Italy, thermal plants in Saudi Arabia and Australia, the first IPP projects in Mali, Ivory Coast and India, and the first greenfield reserve power plants in Germany. These projects were always developed in compliance with international standards of project finance and ISO compliant technological solutions.

We are familiar with all relevant development activities and techniques in the different project phases, including: feasibility studies, securing land rights and way leaves, environmental permitting, obtaining zoning rights, EPC and O&M contracts, interconnection agreements, fuel supply and fuel storage arrangements, financial modeling, insurances, loan agreements, as well as off-take agreements for power and heat.

Financial Modeling

- Proprietary Approach to Building Project Finance Models

- Simplifies Modeling, Making it more Cost Effective and Faster

Project Finance Models

GPFAC has developed a proprietary modeling approach that has gained broad acceptance from developers, project participants, lenders, and international rating agencies. The following differentiate the GPFAC project finance modeling systems:

- We meet standards and utilize common financial parameters.

- The models are of manageable size and much easier to use.

- There is low risk of mistakes with our built-in system of checks.

- They are well documented with clear assumptions.

- Modeling is performed by project finance professionals and not Excel programmers.

This podcast explains our approach to developing sophisticated project finance models from scratch: Financial Model Development PODCAST.

Problems with Most Modeling Approaches

Existing project finance models can be highly frustrating! This is because many are extraordinarily complex – often over 10MB, and nearly impossible to navigate without macros. This results in loss of user control and confidence in the model.

There are no industry standards for detailed project finance models. A common approach is to use an existing model from a similar project. However, in reality, “similar” projects do not really exist, each project has its unique nuances. This increases the complexity of these models.

The other common approach is to build a “super” model with switches to manage all possibilities Here, however, you can end up using only 10% of the model for a specific project. It is like using a hammer to kill a fly.

GPFAC has, over a number of years, developed it own unique approach and standards to project finance modeling.

The GPFAC Solution

GPFAC’s unique and proprietary approach customizes only five project-specific worksheets, instead of the eleven more commonly used. These project specific worksheets are Assumptions, Construction Financing, Depreciation, EBITDA, and Cash Waterfall & Debt Service. The other 6 are the more common financial statements in a fixed chassis that does not change from project to project.

The result is that the GPFAC models are less than one-tenth in size, much easier to understand and a lot more user friendly. We can build such a model, even for a complex project, within only two weeks. Our solution restores confidence, while saving time and money, making its less expensive for our clients.

To further enhance our approach, we have added built-in accounting tests, have created a detailed Assumptions Section and we follow strict accounting disciplines.

Built-in Accounting Tests have been created to ensure the accuracy of our models. These are a part of the chassis that is unique to each project. These are usually not taught in business schools, and they are not necessarily intutive, but always hold from an accounting standpoint.

For each project we create a detailed ‘Assumptions Book’, so that all the assumptions in one place for easy reference and are fully documented.

We ensure Modeling Discipline with clear rules to follow. This results in fewer mistakes, making it easier to auditing and ensuring that the results are accurate. GPFAC is very particular in enforcing these disciplines and part of our process is to ensure these are being followed.

GPFAC works with clients and lenders to develop an easier-to-use monitoring model that meets their reporting needs and also checks compliance with covenants in the loan documents.

Asset Management Models

GPFAC does not recommend that complex models during the development phase be used to monitor a project during operations because:

- Closing models rarely reflect actual costs because of change orders and Force Majeure events;

- Monitoring models do not need construction financing or loan repayment calculations; and

- Monitoring models focus on ‘actuals’ versus ‘budget’ for the near term.

Therefore, GPFAC works with clients and lenders to develop an easier-to-use monitoring model that meets their reporting needs and also checks compliance with covenants in the loan documents.

Project Finance Training Services

-

Project & Structured Finance Training

-

Financial Modeling Training

-

Contract Negotiation Training

GPFAC offers comprehensive training programs in Project & Structured Finance, Contract Negotiation and Financial Modeling.

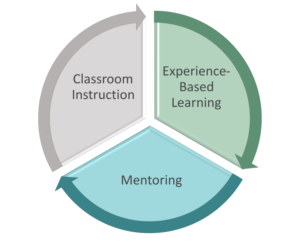

Professional development and training for finance practitioners is important and often undervalued. These programs have three components:

- Classroom instruction

- Experience-based learning (in rotations) and

- Mentoring

Professional development and training for finance practitioners is important and often undervalued. For more on this theme, you can listen to Mr. Mathur’s insight in this Podcast: Professional Development and Training PODCAST.

Our Training Approach

Our approach to training is very different:

- Content is not boiler-plate material downloaded from the Internet.

- It focuses on real knowledge, practical applications, and tools that can be used on the job.

- Its emphasis is on learning by doing (quizzes, exercises, case studies, simulated negotiation).

- Engaging, animated workshops (nobody falls asleep).

- The Instructors are actual project finance and modeling professionals with extensive and current financial closing experience (not academics with limited closing experience).

Extensive Training Experience

GPFAC has extensive worldwide experience in developing and running training programs. Our principals have been delivering these for over 30 years in the US, Canada, Latin America, Western Europe, Eastern Europe, Middle East, Africa, South Asia, and the Far East.

We have customized training specifically to address the training needs of leading companies and institutions including:

- Industrial companies including ABB, and GE Capital

- Government Institutions (US Department of Energy, PDVSA),

- Sponsors/developers such as a US private equity firm, and Nesma in Saudi Arabia

- Financial institutions including Credit Suisse, EBRD, and the National Commercial Bank

GPFAC developed and conducted a comprehensive project finance program for the US Department of Energy. This was specifically designed in consultation with representatives of each department: Origination, Credit, Technical, Legal, and Portfolio Management. Here the participants led program design based on their needs and requirements. It was facilitated by GPFAC.

Library of Training Modules Available

GPFAC has developed a broad range of training modules in the area of Project & Structured Finance, including courses in the following:

- Limited Recourse Project Finance

- Risk Management & Mitigation

- Loan Documentation

- Project Screening

- Negotiation

- Global Financing Techniques

- Loan Syndication

- Joint Development Agreement

- Sales Forecasting

Classroom/Workshop Instruction

(Click to flip for more description)

- A 2-day workshop in Financial Modeling introduces participants to the building of financial models for complex project finance transactions. This focuses on using a financial model instead of building one.

- The 3-day workshop in Project Finance offers a unique, broad, and detailed business perspective on project finance.

- A 4-day workshop on Project Finance and Financial Modeling combined the most essential aspects of the above.

Experience-Based Learning (EBL)

(Click to flip for more description)

- Through short-term assignments (typically of 3-6 months duration).

- Where the objective, over time, is to improve job performance and promote a common credit culture within the organization.

- It is based upon best practices in the industry; and with a detailed framework containing all the administrative tools necessary for implementing a successful program.

Mentoring

(Click to flip for more description)

- An employee (the “Mentee”) is matched with a Mentor (internal or external) with the objective of facilitating the Mentee’s personal and professional career growth.

- This is synergistic with Classroom Instruction and the EBL.

- The duration of a Mentor-Mentee relationship generally is significantly longer than an EBL program.

- The benefits to an organization include Higher productivity, Increased retention rates, and better career development for employees.

A key challenge is ensuring that the role of the Mentor does not undermine the role of the employee’s supervisor.